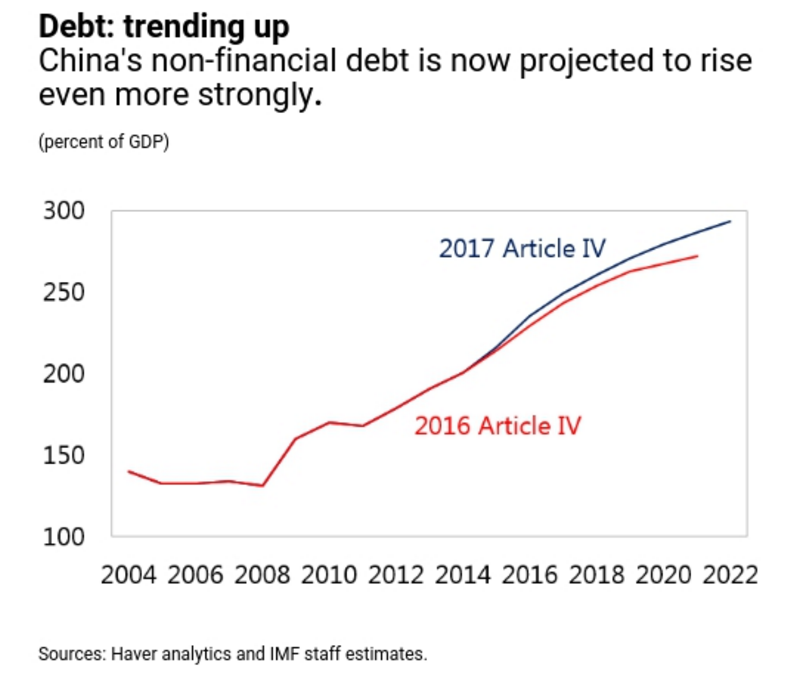

China’s huge debt could trigger the next economic crisis, according to a study conducted by the International Monetary fund (IMF). The country’s borrowing reached unsustainable levels, with the non-financial sector’s credit doubling in the last 5 years.

China’s GDP to credit to GDP ratio skyrocketed to over 230% last year.

The IMF’s report stated that in order to grow the country’s GDP by 5 trillion Renminbi in the last two years, China needed to obtain more credit amounting to 20 trillion Renminbi.

The report states: “International experience suggests that China’s credit growth is on a dangerous trajectory, with increasing risks of a disruptive adjustment or a marked growth slowdown.”

Below is a chart by Business Insider that shows how China’s debt quickly rose from 2004 to the present day.

China – Australia relationship

Aside from the U.S., Japan, and South Korea, Australia is one of China’s most valued trading partners in terms of imports and exports. In fact, Australia is China’s 6th largest trading partner, with 25% of manufactured imports coming from the Asian country.

Currently, a two-way investment relationship is developing between the countries. China ranks 9th as an investor to Australia, with a 3% share of total direct investment.

Should China trigger the next economic slump, investments and exports to China will suffer. Australia is the world’s largest exporter of ore, and China is one of its biggest customers. At least 13% of coal exports are exported to China, and cuts in infrastructure spending triggered by the crisis would affect Australia’s imports of raw materials.

Should China print more money to combat inflation in an economic slump, the Australian Dollar will rally against the Chinese Yuan. The AUD/CNY might not be the most popular currency pair based on FXCM’s live rates on Forex, but historical data shows that the AUD is affected by the volatility of Chinese equity. Any volatility in China’s trade and equities affect the AUD.

The Australian Dollar is particularly susceptible to any volatility in Chinese financial markets given the country’s strong links to the Chinese economy. If given pressure from its largest trading partner, the Reserve Bank of Australia (RBA) may be forced to ease monetary policy and cut interest rates in order to weather the economic crisis. Easing monetary policy and lowering interest rates would devalue the AUD.

China’s growing debt could fuel economic growth

According to some experts, credit expansion may not necessarily be bad for an economy like China. Given that there are productive investment opportunities that need funding, debt can allow them to materialise, leading to economic growth.

However, the effectiveness of credit has been declining in recent years, which suggests that productive investments are getting scarcer. It may also mean that the borrowed money is being put to bad use, which results in overcapacity in industries and hampers productivity.

The IMF report concluded: “The growth outlook has been revised up reflecting strong momentum, a commitment to growth targets, and a recovering global economy. But this comes at the cost of further large and continuous increases in private and public debt, and thus increasing downside risks in the medium term.”

No idea.

I await a assessment by Senator Sam Disartriuos….. he has the china connections.

IMF read WHO read every other fucking joy ride for the one %

“Should China print more money to combat inflation in an economic slump, the Australian Dollar will rally against the Chinese Yuan. ”

There’s a dollar peg, remember? That rally will only happen if China is forced to abandon the peg and devalue. They’re going to pull out all the stops to prevent that, and indeed have already implemented stringent capital controls for that very reason.

As all monetary systems are created by delusion and compliance and there’s no significant unity of purpose within Australia……………………

Who is the IMF to point fingers at anyone? They are the instigators of boom and bust economics.

They are the reason for Australia’s debt since 1914. A question I ask people is. The US is bankrupt, but our dollar is always put at a lower value than theirs, how come? The answer in my opinion, is, manipulation by the likes of the IMF and Soros.

If the IMF was done away with and trade was paid for in gold or equivalent it would not be so easy to manipulate a country’s economic value, as it is with the exchange rate system. That is a set of numbers put in place by a group of bankers, who will benefit mostly from manipulation of those numbers. They never lose!

Why did I use the year 1914? It is because, that is the year that Britain sent us into World War I to set up a bankrupt situation for all western countries involved, so that the Central Banks would lend us credit, created out of cyberspace, so that we would be forever repaying real money in place of their “funny money”. And our politicians at the time, and into the present day, fell for this fraudulent scheme.

The IMF have been preaching gloom and doom about the Chinese economy for years. The “crash” is always just around the corner. It is a good illustration of talking to your preferred audience and ignoring the economic reality. China’s deficit is entirely internal and not subject to external manipulation. Their trade surplus is in the hundreds of billions each year, and foreign exchange reserves are in excess of $4 trillion.

In the past 12 months China has moved progressively toward trading in either Yuan or in the currencies of its trading partners; i.e. bypassing the US dollar. Every Yuan used is backed by gold, convertible on the Shanghai and Hong Kong exchanges.

What is looming is the demise of the petrodollar and with it the capacity of the Americans to endlessly print dollars which others have to buy, thereby enabling the US to defy economic logic and run huge deficits, both internal and external each year without the discipline of a crash in the value of their currency.

This is the single most important economic development of the past few months and will be so for the next 12-18 months.