[Editor’s note: As the saying goes, “follow the money.” For a long time we have understood that our major political parties never discuss money as it should be discussed. They are happy to kick the debt-can down the road, and put Oz assets up for sale. With less than 2 weeks to the Australian Federal, this submission (authored by a farmer) that was emailed to us today seems appropriate. It was written several years ago.]

The Abstract of the research paper below by Cockfield and Botterill shows that agricultural returns in the past five decades have not kept ahead of increasing costs over which primary producers have little control.

Due to the foibles of a supposed free market system, (which should be referred to as a manipulated market) farmers are ‘price takers’ not price makers.

Nation-wide rural debt is said to be some $66 billion largely owed to the banking industry.

This amount is unsustainable and mathematically cannot ever be repaid, unless more than 50% of the total national farmland is sold all at once. Only the Rothschild Bank or perhaps the Chinese government would have the financial acumen to cover anywhere near such a massive debt.

The unsuitability of traditional trading bank finance for the farming industry has never before been so evident that such finance has all but killed primary industries. Combined with drought, poor commodity prices, excessive government regulation and intervention, high road transport and marketing costs and a high dollar, primary producers have never before been so adversely affected.

Traditional bank finance cannot ever cater for such vagaries in farmers’ incomes and over the past decade the nation has experienced the highest rate of bank foreclosures ever seen. Minute by minute, hour by hour, day by day, the interest debt clock keeps on winding up while there are 12 month or longer gaps in income.

Due to foreclosures, the loss of experienced farmers and graziers as wealth creators for the general good of the economy, has reached the point where growing food in an efficient, economic and environmentally sustainable way has threatened the viability of long-term food production of this country.

In most cases where I have had involvement, the unlawful, callous actions of bank-appointed receivers, contracted to do the banks’ dirty work, have been reprehensible.

Two major receiver companies and a financier, which I shall not name in this submission, have acted unlawfully, made false representations to a court, charged fees for services not undertaken, and exorbitantly debited clients’ accounts with massively overcharged fees. They have unlawfully entered property and seized personal items without any authorisation.

Trading banks have a lot to answer. I have assisted financially and environmentally stressed farmers and graziers for more than 30 years. Several of them went out with a blaze of glory, a few were saved, and some committed suicide.

Political parties and courts also should share the blame for allowing this shameful practice to continue. Families have suffered generational scarring.

The Nuts and Bolts of Trading Banks

“Today in Australia, as in most other modem economics, all money is a debt of the banking system. When a banker grants a customer credit by overdraft, the bank ‘opens an account’ in its books and gives the client the right to draw funds without first having to put money into the account. But bank deposits only increase when the customer actually draws on the account to pay his creditors. In the case of loans, funds are deposited directly to the customer’s credit and results in an immediate increase in the volume of money. In either case the money supply increases as a result of the bank’s lending activities. As long as the debt remains outstanding the community’s quantity of money is increased.” — An extract from the article, ‘Sources of Money,’ in the Bank of New South Wales Review, October 1978.

This above quote sums up banking practices in Australia today in a nutshell.

How is that banks can ‘legally’ seize a man’s property, a lifetime of work, for allegedly owing ‘money’ to a bank? Money that was never handed to him as legal tender, i.e., notes and coins as minted by Treasury, in the first place?

“Banking was conceived in iniquity and born in sin. The Bankers own the earth. Take it away from them, but leave them the power to create deposits, and with the flick of the pen they create enough deposits to buy it back again. However, take it away from them, and all the great fortunes like mine will disappear, and they ought to disappear, for this would be a happier and better world to live in. But, if you wish to remain the slaves of the Bankers and pay the cost of your own slavery, let them continue to create deposits.” — Sir Josiah Stamp (Chairman of the Bank of England in the 1920’s, and then the second richest man in Britain)

This criminal activity, explained by Sir Josiah Stamp,(above), has in effect curtailed one and a half centuries of growth in Australia.

Australia with its abundant natural resources should by now have been the richest country on earth.

A Sea of Debt

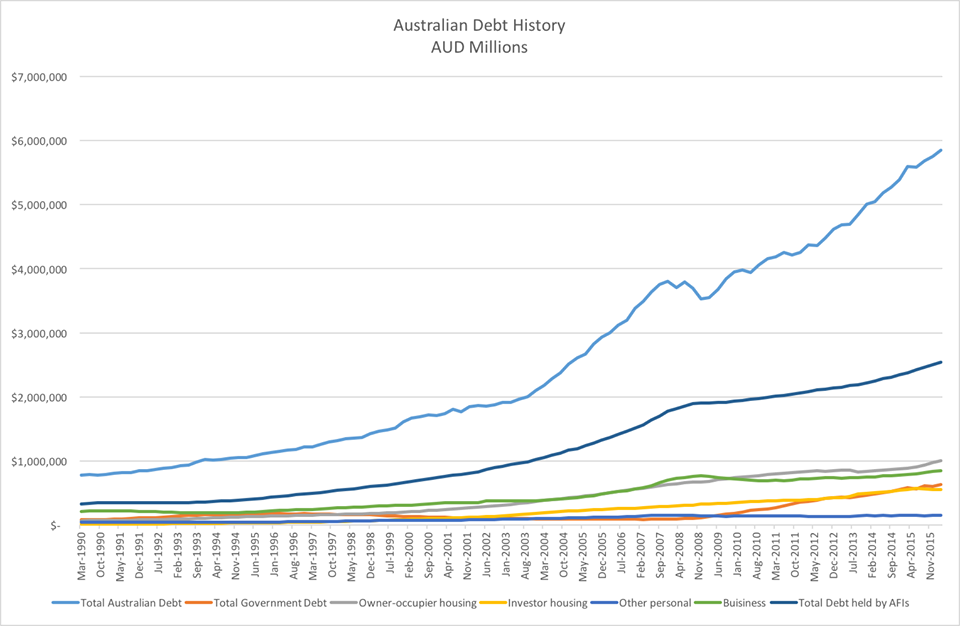

Here in 2015 we are languishing with more than $5 trillion debt [now $7 plus] and sit at about tenth place on the world’s wealthiest nations’ register, according to Business Insider magazine.

In 2016-17 when the economy feels the full impact of the mining industry collapse we will slide much further down the list. Our social security bill is said to be fast approaching nearly one half of our GDP. What has happened to the lucky country? Where are the jobs?

We cannot believe mainstream economists opining there is a shortage of money. There has never been a shortage of money. If we were to tie the value of our resources remaining in situ to the creation of our own credit, our standard of living and national wealth would be at the top of the list.

The Commonwealth Bank operated in this manner until the 1960’s when the illicit banking cartel hijacked our banking industry.

The first official history of the Commonwealth Bank, The Commonwealth Bank of Australia, by C.C. Faulkner, published in 1923, records that prior to World War I, the total of Australia’s Commonwealth and State public debt to London had built up to just over £230 million. Early in the war, the British government made it clear to Australia that the demands of war meant that London wouldn’t be able to keep financing Australia’s borrowing. Consequently, the newly-established Commonwealth Bank took up the challenge. It oversaw 10 War Loan and War Savings Certificate campaigns, which by war’s end had raised more than £250 million for the war effort from inside Australia. Moreover, because the government-owned Commonwealth Bank brokered these loans at cost, the administration expenses amounted to just £705,000, compared to fees to London banks that would have surpassed £5 million.

Firebrand NSW Premier Jack Lang later recounted in his book The Big Bust how the success of the Commonwealth Bank during WW1 threatened the private London bankers monetary control over Australia: [Commonwealth Bank governor] Denison Miller had gone to London after the war finished and had thrown a great fright into the banking world by calmly telling a bankers dinner that the wealth of Australia represented six times the amount of money that had been borrowed, and that the bank could meet every demand because it had the entire capital of the country behind it. A deputation of unemployed waited on him after he arrived back from London at the head office of the Commonwealth Bank in Martin Place, Sydney. He was asked whether his bank would be prepared to raise another £350 million for productive purposes. He replied that his bank was not only able to do it, but would be happy to do it. Such statements as these caused near-panic in the City of London.

This cartel now owns Australia, on paper at least, and successive governments have mortgaged our children’s future to this financial oligarchy.

Link here to the National Debt Clock. The total of this international debt also includes business, household, housing, owner-occupied housing, investor housing, personal and credit card debt. Politicians have no answers other than to deliver up publicly-owned assets in response to the demands of financiers for interest payments.

Operating under our present Keynesian financial system, combined with free trade policies and deregulation we can never repay this alleged debt.

If Australian politicians had the intestinal fortitude to stand up to the usurious international bankers, we could opt out in the same manner as Iceland and Hungary. In 2013 these two heroic little countries kicked out the banking cartel.

The Only Hope — An Australian Reconstruction and Development Bank

In a similar manner to the Rural Reconstruction Board of the 60’s and 70’s Queensland it’s a must to re-establish this financial facility.

To take it to the next step, development funds at the cost of administration only must be made available through a newly created ARDB or a Queensland State Bank that legally does not have to borrow funds from anyone to finance primary and secondary industries. Such a Bank is permitted, indeed encouraged under Sections 51 (iv) and (xiii) of the Commonwealth Constitution of Australia (still in force).

The State should legislate to allow the State Bank entry to the trading banks’ clearing house, the Australian Payments Clearing Association to make its function similar to that of the trading banks.

Toxic trading bank debt must be offset with the newly created credit of the State Bank. This credit will have the same origins as the trading bank credit that was originally created and extended to borrowers as a debt. It comes from nowhere but it is backed by the natural resource assets of the State.

In reality it is a blip in a computer.

—(https://eprints.usq.edu.au/3961/1/Cockfield_Courtney_Botterill.pdf)

The idea of a national bank owned and operated by the Australian public has been discussed by minor political parties for years. However they cannot convince the major parties to give up the blackmail payments to political parties in exchange for Australia’s financial freedom.

The only problems holding Australia’s prosperity back is not having our own National Bank and the politicians denying us that chance.

We did, once upon a time, have such a Bank. Our traitorius politicians saw to the demise of that bank. The COMMONWEALTH Bank of Australia.

I am a simple man so will explain it so , in relation to housing .

When you look at every individuals home loan and realise that for every house the banks make one and a half houses profit minimum .A child can see the injustice , yet we say nothing just sign and commit because there is no other choice , just like in politics .

I’m sure the plight of the farmers is far worse , that’s why half of Oz is owned by the CCP .

If there are 2 million home loans then there’s 3 million houses profit . The amount is bigger than Mt.Everest . Plenty of money for wars and the ones getting it for producing nothing .

Will the banks reduce the debts now the ponzi is crashing ?

They are merciless , this is how they have become to rule the world .

The reserve bank needs to be abolished pronto . Replaced by a national bank that does not charge compounding interest per annum but rather a flat rate for the whole duration of loan if be .

In reality , being tha nations bank creating its own money , they shouldn’t charge interest for the good of all .

Prosperity for all instead of the sleazy international mafia running Oz today .

With their greed , nothing is being maintained adequately , so we are becoming a third world country . Sorry , we are a third world country !

Compared to Nigeria’s debt , we are absolutely !

Revision , pardon error above .

There are three and a half million home loans in Oz .

That’s nearly 9 million houses profit .

Wonder what that figure sums up to total ?

Not feeling well , so all the triple zeros are confusing .

Can anyone calculate ?

Thankyou .

Sorry , correction that’s around 5.3 million houses profit .

Disregard the 9 million figure .

That’s $3.5 trillion .

Profit !!!!!!

The $7 trillion debt is on our plate and not the moneylenders , so why are we financing overseas wars ?

56

You know as well as I do we are allies with the Fascist Americans in their perpetual false flag wars and we sign treaties which curtail Australia’s national sovereignty. Look at the way Australian government has treated Julian Assange.

Until Australia prints and coins ints own currency like the US Republic was ‘supposed’ to do by an act of the US Congress, Australia will continue to buy the money printed and pay interest on it as well. Absolutely madness and insanity!

Australia has surrendered its sovereignty in so many areas to foreign powers. It has always required a Protectorate being a subservient and client state to foreign powers. It has not broken the yoke of serfdom as other countries have.

Over priced as well! Add the criminal stamp duty as well!

The $7 trillion debt is on our plate , not the moneylenders , so why are we financing overseas wars ?

When the money is corrupt, EVERYTHING IT TOUCHES becomes corrupt.

Sound money is the simple answer.

End the Central Banking system.

Problem solved.

All very well but mere politicians don’t have the power to save anyone from anything.

It’s up to every man/woman to wake up to the fact that putting oneself into debt/slavery is part of the human condition

that allowing the wealth/poverty/ownership cycle to become one’s god is, of itself, a death sentence.

That when “gathering sticks:” becomes an addiction one’s doomed

https://growthingod.org.uk/year-of-jubilee.htm

Go to 25min of the Max Igan clip posted by Mary on 3 May:

“what can we do about it?”

“awareness, awareness support each other”

“all we have to do is say ‘no’”

“imagine if the whole World stayed home for a day and didn’t spend any credit cards”

https://www.youtube.com/watch?v=Ov6ZqMeT-MM

I’ve been saying that for years now.

MICHAEL made this comment (accidentally went to the new post, so posting Michael’s comment here)

The Fabian Labor Party changed Australia’s banking capital requirements to capital adequacy from statuary reserves in the mid 1980s. They also floated the currency and made some other adjustments to align Australia with the monopoly capitalism that enriches the few at the cost of the many. Which is why they also killed trade unionism. A pre 1983 banking structure cannot function in a post 1983 Australia. So Ag Banks are just fond memories. The problem with Australia, apart from greed the media has successfully inculcated, is the same problem that has been debated for millenia: usury. Usury is economic and spiritual poison. Even the man made religions were aware of that. Usury has to go but there is no point in trying to tell a politician. Also, social security is not evil. Social security is the government printing money and not the banks. Which is how it should be even if the people in government are without the maturity, mentally and spiritually, to handle the responsibility properly.

It’s a SIMPLE concept.

If the banks and central banks can print money out of thin air, so can the Treasury.(just like it used to do)

INTEREST FREE! (or at least very low just to cover costs)

Why is it so hard to get people to understand such a simple concept??

The Banking System was designed for (((their))) benefit, not ours.

https://www.youtube.com/watch?v=xn6r2Nm0ZMo

WITH USURA wool comes not to market sheep bringeth no gain with usura Usura is a murrain, usura blunteth the needle in the maid’s hand and stoppeth the spinner’s cunning. Pietro Lombardo came not by usura Duccio came not by usura nor Pier della Francesca;

The Jewish Revolutionary Spirit

https://www.youtube.com/watch?v=zmptom00xHk

Text about this persistent problem. Usury!

http://www.renegadetribune.com/ezra-pound-canto-xlv-with-usura/

And they also benefit from immigration. The Right loves it because Cheap Labor! and the Left loves it because 80% of them vote for more government. The right don’t know (or don’t care) that they are slitting their own throats in the process. The banks love it because more competition for housing boosts housing prices. At compound interest that is a very tidy earner.

Having spent 30 years of my life within the RAIL transport industry carrying the produce of the agricultural industry to major ports and holding bins, I did learn a thing or two about the industry, leaving me with no other conclusion, than to state Farmers are responsible to a certain extent, themselves for this situation.

Let me explain. The major transport system for farmers to get their produce to market was RAIL. These rail systems were designed with that objective in mind, thus majority of routes are laid within the agricultural districts to facilitate the transport of their products. (B.T.W. I’m refering to W.A. here, though it applies to other states as well.) Then for some strange reason, farmers decided they had their massive trucks parked in their sheds/paddocks which they bought with loans from the banks, standing idle for half of the year, and started to lobby successive Governments to be allowed to haul to market/ports their own produce. After a four year battle, they succeeded and legislation was introduced to allow farmers to cart their own product to a port within 100 K’s from their location.

Farmers were overjoyed at this win, and drove their trucks full of their grain themselves to the nearest port. Previous to this, the majority was carried by RAIL, trains consisting of seventy wagons long, hauled stock, sheep/cattle/goats/cows to market quickly and efficiently with very little loss. We carried Nitrate for the mines for 100 years without any incidents, trucks took over, and within a few years, two burnt to the ground. Cattle trucks rolled over killing their loads and posing dangers to the public. Rail NEVER had any such incidents.However, they forgot to do their sums. The grain handling facilities were built to cater for rail, not trucks, thus every truck that came thru had to be sampled for the type of grain they had on board, conveyer belts carrying grain to the apropiate bin had to be cleared of the preceeding grain and rerouted to the apropiate bin. This all took TIME. Thus the back log of farmers trucks lining up, awaiting their turn to off load went around FOUR CITY BLOCKS causing mayhem with local traffic and extensive waiting time/loose of production time to the farmers.Need I say it ? Within a very short time, farmers once again, dropped their grain off at the LOCAL receiving location without waiting times. However, some hard heads persisted.

From where I sat, there was a consistent push from the agricultural industry as well as the TRANSPORT industry and their well paid lobbiests, to continual push for changes to the legislation to allow goods to be carted by ROAD that were previously only allowed to be carted by rail at much reduced costs. After all, that’s why billions of taxpayers dollars were spent in designing and building the rail network in the first place.

The lobbying was successful beyond their wildest dreams, everything was opened up for road transport, thus removing the need for rail, and in many cases, hundreds of branch lines were closed due to the reduction of traffic. Ultimately, the Government decided that if the rail system was no longer being supported by the people it was built for, to get rid of this costly Albatross around it’s neck, and placed it on the market for sale. The buyers immediately cut back further uneconomical routes and closed many others only keeping the lucrative profitable ones open, the grain industry is being charged top dollar for their transport requirements by rail.

And the road transport industry is also, laughing all the way to the bank, at the handsome profits they too are reaping.

So, at the end of the day, the farmers themselves are victims of their own greed and short sightedness. I feel no sympathy for them, as all this eventually coming home to roost, was obvious to anyone who took a good look at the way things were going

Today, with the rise of fuel cost/registration/insurance/service of the road transport fleet, they have no other option but to raise their prices accordingly, where previously with RAIL, those costs were carried by the Government and absorbed by the treasury dept. . B.T.W. I too witnessed the broad acre change persued by Banks demands from farmers to “get big, or go under”. Millions of arable acreage was destroyed by bulldozers introducing INDUSTRIAL farming methods, destroying the soil and allowing any moisture in the ground to disipitate and assist the droughts we now face.

Massive damage has been done to our agricultural industry at the behest of the BANKING industry in Australia.

Ultimately, the folks who had the final say, were the farmers. They could have always told the Bankers, No Way, bugger off.

As the destruction of freight and passenger rail in WA started in the late 1930s it was probably the vanguard of the “privatisation” phenomena. I don’t think the farmers can be entirely blamed but it is interesting that, bar public protest, the Perth – Fremantle line would also have been demolished.

Honest Government Ad | 2019 Election (Season Finale)

https://www.youtube.com/watch?v=OJrXI3rBbSA

Rod Culleton entered politics with the specific intention to address the matters raised in this article. His short lived life in the Senate proves how powerful someone is. Might this be the banks?

In this very election coming up this weekend you all have the opportunity to support Rod via the Great Australia Party to finish the work he set out to do. His work is half finished. Even the British Govt has been served papers and will have to perform.

If you want Rods work to be completed the VOTE GAP 1.

To those who want to the raise the issue of Rods alleged bankruptcy. Yes bankruptcy proceedings were initiated and a sequestration order was issued however NOT ONE CREDITOR has signed the creditors partition, meaning that Rod Culleton owes NOTHING to any creditor.

By the way: what happened to the law of vexatious and frivolous proceedings regarding the $7 truck key that is at the heart of the alleged bankruptcy???